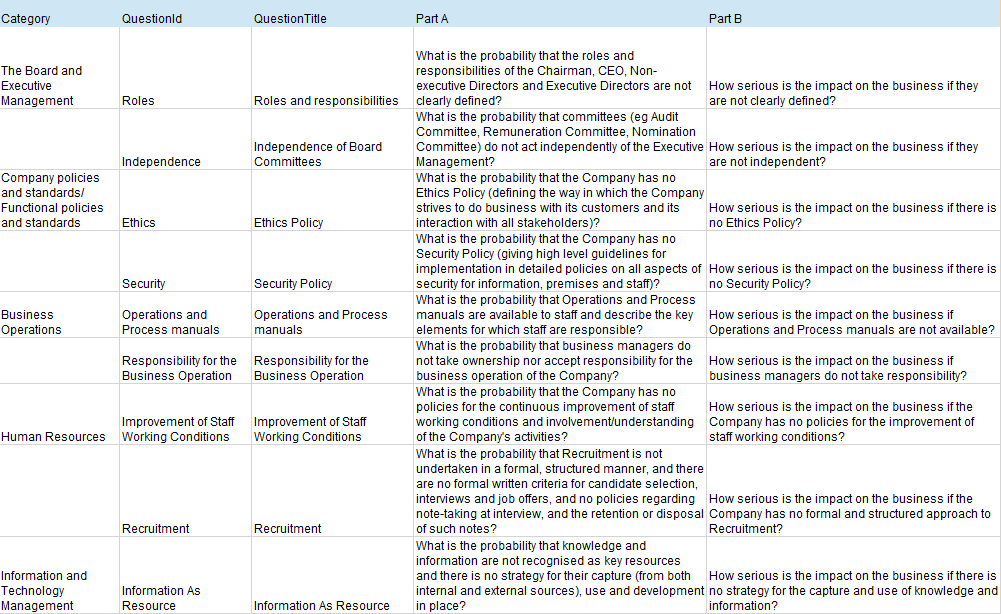

Who Needs Private Medical Insurance?

Companies wishing to facilitate quality, cost effective, preventative Private Healthcare for their employees health with the option to also have dependents covered.

Concerned with the level of healthcare available both on a cost and quality basis within Iraq, Almaseer created the most flexible cost effective solution to both issues for both Iraqi Nationals and Expats working within Iraq.

It took two years of extensive research to finally be able to realize our ambitions. In November 2017 we launched our range of healthcare products in partnership with several specialist Heathcare Reinsurers.

We offer local claims servicing assistance with our Arabic, English, and Kurdish Claims Assistance Unit based in Baghdad including an in-house medical practitioner. With our specialist medical reinsurers assist we provide a full range of specialized claims assistance facilities including treatment preauthorization, Repatriation services and the issue of certificates of authorization for inpatient treatment. Outpatient claims that total under USD500 are dealt with here in in Baghdad on a reimbursement basis which we aim to turn around very quickly and promptly with a simple claims’ procedure.

For those clients that need cover outside of Iraq we can provide cover on a regional basis up to worldwide cover including North America. Our reinsurers don’t restrict themselves to a single care provider but have service contracts in place globally with household name regional Emergency response companies. In addition, via our reinsurers we have access to more than 1,000,000 medical and associated specialist service providers in 206 territories/ countries.

Networks and Iraq

In Iraq this is a major issue where there are no network providers local to a scheme member – especially true for companies working in remote oilfield areas.

Our concept is simple NO RESTRICTIVE HOSPITAL, CLINIC, DOCTOR OR PHARMACY LISTS. For inpatient and day patient care a scheme member can seek treatment anywhere within their chosen territorial area. Provided guidelines for preapproval are followed they are free to use any facility.

For Outpatient treatments we do not require preauthorization for treatment / consultations below USD500. This differs greatly from other schemes where preauthorization levels can be as low as USD50. Claims settlement is provided for on a reimbursement basis where we supply the member and their medical provider with a simple form including the Healthcare Providers certificate to complete in Arabic or English. For our Global scheme members, the same principal applies (accept in respect of the USA where the network provider must be used for non-emergency treatment ).

What we can offer

We can offer a range of schemes from purely cover in Iraq [with the option to have cover in Turkey via Acibadem private healthcare] through to full global coverage including North America.

If you would like more detail, please click on Key Facts which summarises the extent of the cover we can provide but note that certain benefits are only available on specific plans.

for those companies with more than 200 employees, we are happy to talk about customized coverage and limits as an alternative to our standard plan offerings.

Key Facts

Please check out the key facts details in order to find the information and technical details you need to know about your insurance.

Quotations and Indications

Whilst we will undertake to provide a quotation or indication if requested for business presented to us, we cannot make any promise or guarantee that we can provide a quotation or indication.

Where we do provide a Quotation or Indication it will be ‘open’ for a number of days during which it can be bound. If cover is requested after this time has expired there is no guarantee that:

- Terms will be the same as originally indicated

- We will be able to provide a quotation or indication

We may therefore have to requote the risk and additional information may need to be supplied.

Where we have indicated that the cover is ‘Subject to’ a number of items either being provided or completed prior to issuing the policy and going on cover. These must be completed and confirmed acceptable by us in writing before we can issue coverage or where we have waived them this will only be if we have confirmed the waiver in writing.

General FAQs

The Financial Services Sector has strict rules in respect of Sanctions and Money laundering. By supplying us with the information we have requested we are able to run sanctions checks for sanctioned companies and individuals. We must do this to comply with Iraqi Government and Global Sanctions legislation. Our reinsurers also request the same information about you from us which is another reason we request it as without this we would be unable to obtain reinsurance and therefore be unable to offer you cover.

Occasionally we will request further information to assist in sanctions checks. This is not unusual as many people and sometimes companies, share the same name as an individual or entity appearing on a sanctions list. The additional information assists in making sure the correct entity or Individual is approved or rejected.

The contract along with the Statement of Work and if available Project Plan, provides us with information as to what you are doing. This information is key to the underwriting process and will normally contain the Material Information that you have a duty to disclose to us. We are sometimes within the contract asked to assume ‘Liability assumed under Contract’ and/or ‘Cross Liabilities’, and to do this we have to have sight of the contract to understand exactly what risk is being transferred from you to us as your insurer and in turn for us to transfer the risk to reinsurers.

We understand this which is why we are prepared to sign non-disclosure agreements which make it clear what we do with your data and who has sight of it. If you are still reticent about supplying the contract Contact Us to see what we are able to do.

Yes. As a fully licenced Insurance and Reinsurance company we are regulated by the Iraqi Diwan who annually renew our licence. All Insurance/Reinsurance companies and Brokers (Insurance and Reinsurance) who state they are regulated in Iraq are issued a licence which is renewed on an annual basis with a licence confirmation for the current year issued.

We accept a number of currencies these being Iraqi Dinar (IQD), US Dollar (USD) and Euro. We do not accept other currencies for Premium Payment.

No, we do not accept crypto currencies of any sort for payment.

All our policies contain the following which makes it clear how your data is utilised by us and others:

"How we use your information:

The information supplied to us by you may be held on computer and passed to other insurers and reinsurers for underwriting and claims purposes.

We may use your information for underwriting and claims purposes, statistical analysis, management information, market research, audits on the handling of claims, systems integrity testing and risk management.

We will only share your information as described in this notice or where we are required or allowed to do so by law.

We may record or monitor telephone calls for security and regulatory purposes.”

In certain claims circumstances we use standard industry protocols which enable us to provide ‘sanitised’ data where the claimants details are removed so as not to make the individual person identifiable.

We do not release or share information except under the circumstances shown above.

Related Sector FAQs

No, our plans are designed to cover companies or organisations such as state departments or ministries ideally having more than 15 employees (dependants do not count towards this total) but will consider plans from 5 employees subject to full underwriting information and subject to minimum premium requirements which vary depending on the plan chosen.

Yes. All our plans can include a spouse or adult partner who is permanently living with you, any unmarried children (including step, foster and legally adopted children) providing they are under 21 (or under 24 if in full time education) when they are first added to the policy and at each subsequent policy renewal date If this option is chosen all eligible dependents must be added to the plan. Contact Us for more information.

No. A simple medical questionnaire is all that is usually required. If we need any further information to access your application fairly and accurately, we may request a medical report from a doctor.

Since the purpose of your policy is to provide cover for unforeseen medical problems that arise after the date of joining, no cover is normally provided for those conditions that pre-existed the inception date of the policy. In certain circumstances, such as the number of plan participants or cover requested, we can consider offering cover for pre-existing conditions.

Contact Us for more information.

We can cover chronic conditions under several plans we offer usually subject to a waiting period. Contact Us for more information.

Cover will not be cancelled because of the number of claims made or a change in the state of health of the plan member.

Cover for Maternity and childbirth is available under certain plans we offer and is subject to a waiting period from the inception date (or the date of an upgrade if transferring from a lower Level of Cover) of the expectant mother’s cover.

Outpatient prescriptions that are prescribed by a qualified medical practitioner are covered under all but the Basic Plan level, up to their respective plan limits. Certain medications, such as dietary supplements and nutritional products are not covered. Any medication that can be obtained over the counter will not be reimbursed even if included within a prescription.

There are 2 different aspects to the dental cover provided: Emergency dental treatment for immediate pain relief where required as a result of an accident causing damage to sound natural teeth under all plans (except in our Basic plans), we will pay for treatment that where given within 48 hours from the time of the accident.

We also offer Routine & restorative Dental Care treatment under several our other plans subject to varying policy limits depending on the plan chosen.

Please note that costs are subject to waiting periods and mandatory co-payments.

Benefit is available under all Levels of Cover for the medical treatment incurred in respect of a kidney, heart, heart/lung or liver transplant to the respective limits shown. No cover however is available for the implantation of an artificial heart and the costs associated with locating/removing a donor organ and any associated administration costs.

Yes, where regional, global or specific territory is covered and this includes your home/passport-holding country when you first joined you can have treatment in your home territory. Under our plans covering Iraq only you can have treatment at any Acibadem hospital in Turkey subject to Usual and Customary Reimbursment applying to the treatment.

- The charge usually made for it by the provider who furnishes it, and

- The prevailing charge made for it, in the same geographic area, by those of similar professional standing.

- The complexity involved

- The degree of professional skill required

- Other pertinent factors

Our preferred method of reimbursement is payment direct to your bank account or send you a cheque, for Iraqi nationals we would normally make a direct payment into their nominated bank account or use one of the widely available certified cash transfer agencies. Only under exceptional circumstances and subject to a strict procedure would cash reimbursement be entertained. There is a section on the claim form that will ask the member to indicate their preferred method of reimbursement.

As with all insurance policies, there has to be a number of items of expense, which cannot be covered for full details on the terms, conditions, and exclusions of the policy, you should refer to the policy wording.

Co-payment is the portion of a covered expense that must be paid by the member. There are two types of co-payments: general policy co-payments and benefit-specific co-payments. The Company currently offers three general policy co-payment plans: 10%, 20%, and 30%. For custom limit plans we can consider differing Co-pay limits. The policy co-payment plan may only be changed when you renew your policy, not mid-term.

Under our money-back guarantee, please return this Policy together with written cancellation instructions to us within 14 days of the date of issue stated in the certificate. If no claim has been made, the premium will be refunded in full.

Claims

A company’s wealth can be affected by circumstances beyond their control, for example a fire. An insurance policy enables a company to transfer the risk from fire and other perils by way of an Insurance contract (the Policy) to a third party (the Insurer) who will compensate you / Indemnify a third party for the damage or loss, subject to the policy terms conditions and exceptions.

You need to be certain the cover is correct for the risks being insured, if it is not then any claim may be withheld or reduced by the application of Non-Disclosure, Average or Indemnity protocols.

We have a track history in dealing with both large and small losses, for complex losses we and our reinsurers will nominate Independent Loss Adjusters to work with you to calculate your loss in line with the policy terms and conditions.