Private Medical Insurance

Private Medical Insurance

We Can Provide The Following Cover

We offer a range of schemes providing cover in purely for Iraq through a number of standard options to a full global coverage including North America.

Please read the information which summarises the extent of the cover we can provide but note that certain benefits are only available on specific plans. For those companies with more than 200 employees we are happy to discuss customized coverage and limits as an alternative to our standard plan offerings.

if the information you require is not shown then please contact us with your requirements and we will see if we can assist.

- Companies (Private or Public)

- State Owned entities

- NGO’s or similar

- Ministries or Government Bodies

- Age 65 for a person to be insured for the first time in his/her life.

- Renewals on an existing policy are possible up to the age of 74. Coverage terminates at the end of the policy period following attainment of age 75.

- For dependent children Up to 18 (24 for students).

We will need to be provided with details of the employees and dependents if cover for them is required in the following format

- Minimum group size is 5 primary insured

- All eligible employees must be enrolled (primary insureds).

- Coverage for dependents may be written on a mandatory or voluntary basis. If mandatory, then all eligible dependents must be enrolled. If voluntary, then eligible dependents must submit a medical health statement and coverage will be underwritten and is not guaranteed.

- An employee/employer relationship must exist. Independent contractors and consultants are not eligible.

- All employees must be actively at work and full-time staff (minimum 20 hours) on the effective date of the group plan. Employer must declare any knowledge of employees not actively at work or employees anticipated not to be actively at work.

- Payroll records may be requested at underwriter discretion to verify the employee/employer relationship and actively at work status.

Applicable while the group’s headcount exceeds 20 primary insureds

- All plans, under specific sections have waiting periods that apply for certain types of treatment. These can vary on a number factors these being:

- Plan territory covered

- The extent of cover offered under the plan type

- The number of employees can also effect whether a waiting period is applied for certain coverages only

These waiting period applies to all employees and dependents including newly added employees/dependents as they are enrolled throughout the year.

The waiting periods under the standard policies we offer are as follows:

| Cover Section | Waiting Period |

|---|---|

| Inpatient Treatment in a psychiatric clinic | 11 Months |

| Psychiatric out-patient consultations and prescribed Drugs | 11 months |

| HIV/AIDS | 22 Months |

| Adult Health Screening (Check-up) | 11 months |

| Compassionate Trip Home | 11 Months |

| Dental | 6 Months |

| Chronic conditions | 11 Months |

| Maternity | 11-Month waiting period. The date of conception may only be confirmed at least 11 months after the policy inception date (or the date of an upgrade to a higher plan), otherwise maternity will not be covered. |

Waiver of the waiting period: Waiting periods indicated shall not apply to those insured persons, who were covered under the same insurance plan (or the insurance plan which had similar benefits and waiting periods) before being enrolled in the list of insured persons under our policy , subject to:

- There being no break in coverage between the prior plan termination and the effective date of coverage with us.

- Invoice from prior carrier is provided, showing insured employees / dependents and date premium is paid from and through (must be 12 months minimum),

- a official summary of benefits/copy of policy from the prior group plan is provided.

- Charges in excess of usual and customary

- Cosmetic & elective surgery

- Addictive conditions

- Professional or Hazardous sports/activities

Limits Available

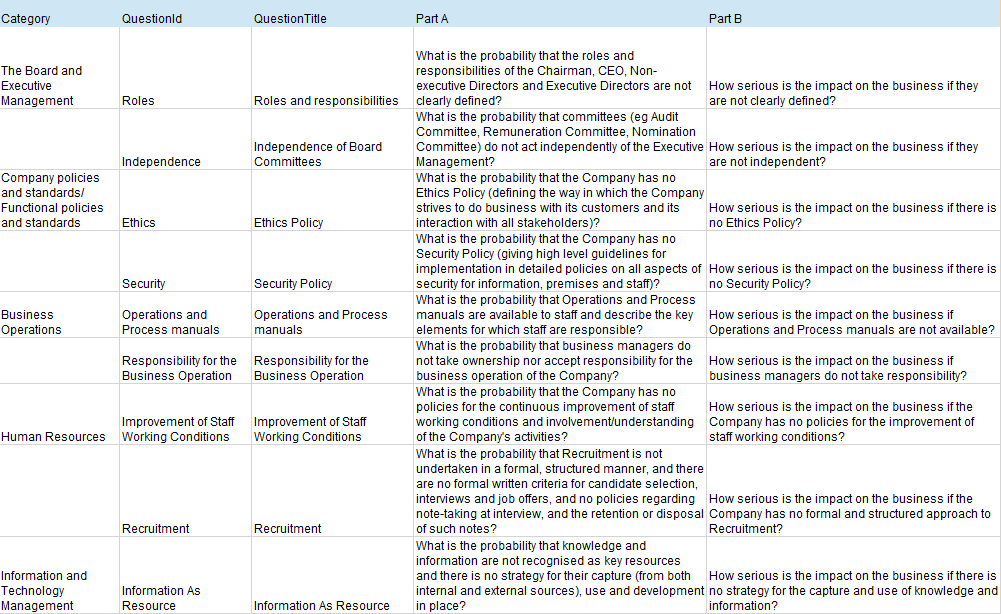

The table below summarise the cover that can be provided under our plans.

Note that the following applies to all plans indicated.

“Paid in full” below means that relevant expenses shall be paid or reimbursed within the individual Sum Insured, under conditions that such expenses are Usual, Customary and Reasonable, and relevant Treatment is Medically Necessary.

Amounts below mean Limits of possible reimbursement of actual cost paid/expenses incurred under relevant items, under condition that such costs/expenses are Usual, Customary and Reasonable, and relevant Treatment is Medically Necessary.

Number of visits/days/nights means that the reimbursement shall be based on the actual number of visits/days/nights, but no more than for the number visits/days/nights indicated below

| Sum Insured per person (all sections combined) | Global Healthplan |

| Iraq Only (inc ACIBADEM hospitals in Turkey |

| We can offer cover from USD1m to 3m per person under our standard Plan. For plans with more that 200 members customisation of limits is available | From USD80,000 to USD500,000 | ||

| Primary Area of Cover | Areas Covered* AREA I: Europe excluding Switzerland, Russia and UK AREA II: Worldwide excluding Nth. America, Switzerland, Russia, UK, China, HK & Singapore AREA III: Worldwide excluding Nth. America AREA IV: Worldwide (maximum continuous stay of 3 months in Nth. America), for stays of more than 3 months please refer to the Underwriter · There is flexibility in territorial Areas dependant on scheme size | Iraq & ACIBADEM Network Turkey Only | |

| HOSPITALISATION Planned and emergency In-patient Treatment (including day-patient), except for dental Treatments | |||

| Accommodation and meals | A Standard or Semi-Private room to a Superior private room depending on plan chosen | A Standard or Semi-Private room to a Superior private room depending on plan chosen | |

| If the room of the level specified in the Schedule of Benefits is not available at the time of admission, then the Usual, Customary and Reasonable expenses for the lower level accommodation conditions shall be paid for/reimbursed. The Insured Person is allowed to select any of the available categories of more comfortable rooms, however, the reimbursement will be limited to an amount corresponding to the accommodation in room level specified in the Schedule of Benefits, while the difference in the accommodation cost must be paid at Insured Person’s own expense. | |||

In-Patient Treatment Costs and fees of attending Doctor, Surgeon and anaesthetist, other medical staff involved – for Treatment, consultations, development of Treatment plan, Surgery and medical manipulations, conservative Treatment or monitoring as well as other Medically Necessary services, Day-Care Treatment | paid in full | paid in full | |

| Operating theatre, emergency room, recovery room, intensive care unit (ICU), coronary care unit, high dependency unit | paid in full | paid in full | |

| Diagnostic tests, laboratory and instrumental tests, electrocardiograms; medical imaging (X-Rays, CT, MRI, PET) | paid in full | paid in full | |

| Drugs, dressings, medical materials (bandages/surgical dressings, casts, plaster, etc.) | paid in full | paid in full | |

| Parental Accommodation with an insured child aged under 16 | From 30 nights to 50 nights dependant on Plan chosen | not covered | |

| Per night limit | 100 | ||

| Accommodation for a baby who is breast fed with the insured mother | Depending on plan chosen from no cover provided to Paid in Full | not covered | |

| Inpatient Treatment in a psychiatric clinic or unit | Depending on plan chosen from no cover provided to 30 nights | Depending on plan chosen from no cover provided to 30 nights | |

| (subject to 11 months Waiting Period since entry into force of the insurance cover under the Contract in respect of the Insured Person concerned) | |||

| Reconstructive Surgery | paid in full | paid in full | |

| Internal Prosthetic Devices and aids | paid in full | paid in full | |

| Transplantation of kidney, heart, heart-lung, liver, bone marrow and stem cell treatment | Depending on plan chosen from 100,000 to 200,000 | Depending on plan chosen from 50,000 to 100,000 | |

| Palliative Treatment of terminal Illness & hospice care | Depending on plan chosen from not covered to 40,000 Note Limit is a Lifetime limit not per year limit | not covered | |

| Hospitalisation Daily Allowance (Alternative to reimbursement of Hospitalisation costs) | Depending on plan chosen from 100 per night to 150 per night | not covered | |

| Subject to maximum of 20 to 30 nights dependant on plan chosen | |||

| POST-HOSPITAL TREATMENT | |||

| Rehabilitation course in the profile Rehabilitation centre, immediately following inpatient Treatment | Depending on plan chosen from not covered to 1,500 | Depending on plan chosen from not covered to 1,000 | |

| Physiotherapy outpatient, if prescribed by the Doctor in connection with and immediately following the inpatient Treatment | Depending on plan chosen from 20 to 40 visits per plan year | Depending on plan from 20 to 30 visits per plan year | |

| External Prosthetic Devices and aids which are medically required following Hospitalisation, Day-Care Treatment or Accident and emergency room Treatment | Depending on plan chosen from 800 to 1,500 | Depending on plan chosen from not covered to 1,000 | |

| ONCOLOGY TREATMENT | |||

| Consultations, tests, radiotherapy or chemotherapy, take-home Drugs received as an In-patient or as an Out-patient at a Hospital or a registered Cancer Treatment centre following discharge from Hospital confinement or Surgery | paid in full | paid in full | |

| Cost of a wig/hairpiece if required following a course of cancer Treatment | Depending on plan chosen from 800 to 1,500 | Depending on plan chosen from not covered to 1,000 | |

| OUT-PATIENT CARE (except for ONCOLOGY TREATMENT and dental Treatments) | |||

| Treatments and consultations received from private Doctors and from out-patient clinics | Depending on plan chosen from 2,000 to paid in full | Depending on plan chosen from 2,000 to 8,000 Subject to 20% co-pay | |

| Fees of GPs, Family Doctor, Specialist, also in case of visiting patient at home | |||

| Prescription Drugs & dressings | |||

| X-rays, diagnostic and pathology tests, instrumental tests, electrocardiograms | |||

| Hi-tech scans (CT, MRI & PET) | |||

| Hormone Replacement Therapy | Depending on plan chosen from 2,000 to paid in full | Depending on plan chosen from 2,000 to paid in full | |

| When not related to the menopause | |||

| Physiotherapy | Depending on plan chosen from 10 to 20 visits per plan year | Depending on plan chosen from not covered to 10 visits per plan year | |

| When prescribed by a Physician | |||

| Alternative/Complementary Medical Practices (available after the Insured Person pays the first two visits by himself/herself): | |||

| Acupuncture, needle therapy, aromatherapy, chiropractic, homeopathic, naturopathic, and osteopathic medicine, Ayurvedic and Traditional Chinese medicine, hydrotherapy | Depending on plan chosen from 10 to 30 visits per plan year | not covered | |

| limit per visit | Depending on plan chosen from 35 to 50 | ||

| Prescribed drugs limit and co-pay applicable under homeopathic and Chinese medicine | Depending on plan chosen from 350 to 1,000 | ||

| Subject to 20% co-pay | |||

| Nursing at Home | Depending on plan chosen from not covered to 90 days | Depending on plan chosen from not covered to 90 days | |

| Psychiatric out-patient consultations and prescribed Drugs | Depending on plan chosen from not covered to 3,000 | Depending on plan chosen from not covered to 1,500 | |

| (subject to 11 months Waiting Period since entry into force of the insurance cover under the Contract in respect of the Insured Person concerned) | |||

| Restorative speech therapy | Depending on plan chosen from 5,000 to 10,000 | Depending on plan chosen from not covered to 5,000 | |

| Subject to 50% co-pay | Subject to 50% co-pay | ||

| RESTRICTIONS AND LIMITS APPLICABLE TO CERTAIN MEDICAL CONDITIONS OR EVENTS (Waiting Periods and limits indicated in this section prevail over those envisaged elsewhere in the Schedule of Benefits) | |||

| Chronic Conditions (other than malignant tumour, congenital and hereditary conditions): Consultations, In-Patient and Out-Patient Treatment & Drugs (subject to 11 months Waiting Period since entry into force of the insurance cover under the Contract in respect of the Insured Person concerned) | Depending on plan chosen from 3,000 to 7,000 | Depending on plan chosen from not covered to 5,000 | |

| HIV/AIDS: Consultations, In-Patient and Out-Patient Treatment & Drugs (subject to 22 months Waiting Period since entry into force of the insurance cover under the Contract in respect of the Insured Person concerned) | Depending on plan chosen from 15,000 to 25,000 Note Limit is a Lifetime limit not per year limit | Depending on plan chosen from not covered to 15,000 Note Limit is a Lifetime limit not per year limit | |

| Congenital / hereditary diseases | Depending on plan chosen from 2,000 to 5,000 | Depending on plan chosen from not covered to 2,000 | |

| only for children up to the age of 18 | Depending on plan chosen from 10,000 to 25,000 Note Limit is a Lifetime limit not per year limit | Depending on plan chosen from not covered to 10,000 Note Limit is a Lifetime limit not per year limit | |

War and Terrorism Limits Individual limit per Insured Person per event, but subject to the Aggregate limit per event | 175,000 all plans | Depending on plan chosen from 100,000 to 175,000 | |

| Aggregate limit per event | 700,000 all plans | 700,000 all plans | |

| DENTAL CARE | Depending on plan chosen from 500 to 3,000 | Depending on plan chosen from not covered to 500 | |

| Subject to 20% co-pay | Subject to 20% co-pay | ||

Depending on the plan chosen cover is from Basic Dental Restorative Treatment Only to Basic Dental Restorative, Preventive & Diagnostic Treatments Cover is subject to Waiting Periods of 6 to 11 months depending on plan chosen starting from date insured person joins plan | Depending on the plan covered from not covered to providing Basic Dental Restorative Treatment Only Cover is subject to a waiting period of 6 months starting from date insured person joins plan | ||

| DENTAL TREATMENT FOLLOWING AN ACCIDENT | Depending on plan chosen from 2,000 to 5,000 | Depending on plan chosen from not covered to 1,000 | |

| MATERNITY CARE (subject to 11 months Waiting Period for Pregnancy conception from the inception date of the MATERNITY CARE coverage. Limits below established on a per Pregnancy basis) | |||

| Normal Pregnancy and Childbirth | Depending on plan chosen from not covered to 12,000 | Depending on plan chosen from not covered to 5,000 | |

| Complicated Pregnancy and Childbirth | Depending on plan chosen from not covered to paid in full Where a plan has a cash limit to the cover provided in life-threatening situations paid in full | Depending on plan chosen from not covered to 20,000 (but in life-threatening situations paid in full) | |

| New-born Care within first 14 days since the baby’s birth date | Depending on plan chosen from not covered to 75,000 Where cover is provided a private room covered | Depending on plan chosen from not covered to 5,000 Where cover is provided a private room covered | |

| PREVENTIVE CARE | |||

| Well Child Care | Depending on plan chosen from not covered to 1,000 | Depending on plan chosen from not covered to 500 | |

| Subject to 20% co-pay | Subject to 20% co-pay | ||

| Adult Health Screening (Check-up) | Depending on plan chosen from not covered to 1,000 | Depending on plan chosen from not covered to 500 | |

| (subject to 11 months Waiting Period since entry into force of the insurance cover under the Contract in respect of the Insured Person concerned) | Subject to 20% co-pay | Subject to 20% co-pay | |

| Vaccination | Depending on plan chosen from 100 to 500 | Depending on plan chosen from not covered to 100 | |

| LOCAL ROAD AMBULANCE if arranged by the Assistance Service | paid in full | paid in full | |

| EMERGENCY CARE | |||

| Emergency Medical Evacuation In acute medical conditions when proper medical aid cannot be arranged locally | 1,000,000 | Depending on plan chosen from 50,000 to 100,000 | |

| Emergency Medical Evacuation – Companion Related Costs | 3,500 | 3,500 | |

| Companion Flight ticket | Economy | Economy | |

| Hotel accommodation limit for companion | 14 nights | 14 nights | |

| Taxi / transportation costs of companion visiting the Insured Person hospitalised, per day | 150 | 150 | |

| Hotel accommodation limit for Insured Person upon the end of Hospitalisation | 5 nights | 5 nights | |

| Compassionate Trip Home (subject to 11 months Waiting Period since entry into force of the insurance cover under the Contract in respect of the Insured Person concerned) | Economy | not covered | |

| Repatriation or Burial locally | Depending on plan chosen from 15,000 to 20,000 | Depending on plan chosen from 15,000 to 20,000 | |

| Emergency Care out of Primary Area of Cover | 100,000 | not applicable | |

| Depending on plan chosen from 30 to 60 days | |||

use of captives

Almaseer are used to captives participating in Insurance Programs and will discuss a clients / potential clients captive utilisation in their programme based on the clients own unique needs.

information required

We try to keep information requirements to a minimum however to provide you with competitive terms we do require time to be able to assess the information to be able to provide our most competitive terms. If you require a quotation within 48 hours of contacting us then we will not be able to assist.

To obtain the best terms it is preferable to provide a minimum of 14 days to enable the information to be assessed and any queries raised answered. This is especially relevant to quotations where cover is to take over an existing scheme or where there has been an existing scheme in the previous 3 years.

Whilst the general information we require is the same as to whether you have had cover in the past or Private Medical Insurance is completely new to you, there is additional information that we require should you either have a policy or had one within the last 36 months

- A completed employee Census

- We prefer to be provided with a full census in the following format ‘PMI Census ‘A’+’ this will provide the information required to give you a bindable quotation.

- If this information is not immediately available, then more general information can be provided as per ‘PMI Census ‘B’+’

- Details as to the Plan required which will need to include:

- Territories cover is required for

- Overall Plan limit per employee

- Details of the existing plan coverage if you require us to provide cover on the same basis or details as to the new coverage that is required

- A full claims experience for the previous five years or duration of the plan if the plan has been enforced for a shorter period of time.

In either case please contact us should you require any help or further information concerning our private medical insurance coverage

| Travel Schedule of Persons To be covered: | ||||||||||

| Emp No. | Title | First Name | Middle Name | Last Name | Age | Gender | Date of Birth | Dependent Y/N | Occupation | Pre- Existing Medical Condition |

If you cannot supply the above, then we can possible indicate on Age band information but please contact us prior to sending anything in in case it will not be sufficient for ours and our reinsurers underwriting needs. Prior to binding any cover we will need the information in the above format.