Marine and transit

Marine and Inland Transit

We Can Provide The Following Cover

Marine cover is recognised as one of the oldest insurance covers having been in existence for many thousands of years literally from the time of the Phoenician trading empire and has evolved over time to the modern-day form covering losses arising from physical damage to, or loss of, goods whilst being transported around the world, by Air Sea or Land.

Please read on to see what We can provide cover for those transporting goods by Air Sea or Land, please check the sections below careful but if the information you require is not shown then please contact us with your requirements and we will see if we can assist.

underwriting guidlines

Please click on the heading below to learn more about our underwriting criteria

- Single trip cover available to cover one-off movements

- Annual Marine Open cover policies for those importing/exporting goods on a regular basis.

- Project coverage for the duration of the project, covering critical plant and machinery as well as normal goods incorporated within the works

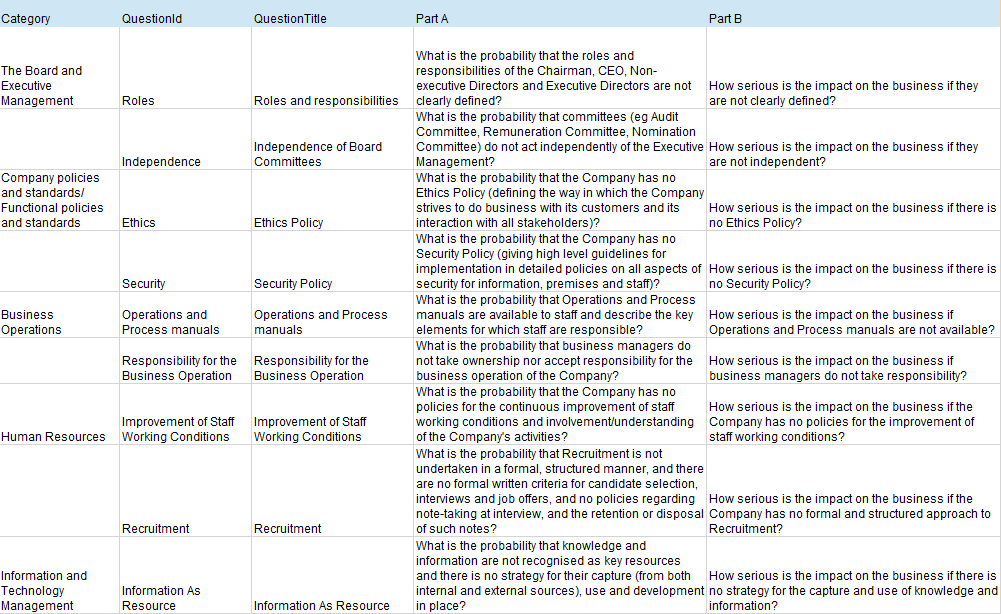

| Cover Type | Basis of Valuation |

| Inland transit’s [purchases and sales] including the subject-matter insured sold FOB, C&F or on similar terms | Invoice cost to the buyer |

| Imports or Exports | invoice cost or CIF plus 10% plus duty if incurred |

| Storage – unsold goods | CIF plus 10% plus duty if incurred |

| Storage – sold goods | Invoice cost to buyer |

| Returned goods | Market value at the time of loss or invoice cost whichever is the lesser |

| All other subject-matter insured which is not subject of a purchase or sale invoice | Market value at the time of loss |

A brief explanation of What FOB, C&F, CIF mean: Bold just highlights the word no drop down or hover

- Free on Board(FOB) is an international legal shipment term used to indicate whether the seller or the buyer is liable for goods that are damaged or destroyed during shipping. “FOB shipping point” or “FOB origin” means the buyer is at risk once the seller ships the product.

- Cost and freight (CFR) is an international legal shipment term used in foreign trade contracts. In a contract specifying that a sale is cost and freight, the seller is required to arrange for the carriage of goods by sea to a port of destination and provide the buyer with the documents necessary to obtain them from the carrier.

- Cost, insurance, and freight (CIF) is an international shipping agreement, which represents the charges paid by a seller to cover the costs, insurance, and freight of a buyer’s order while the cargo is in transit. Cost, insurance, and freightonly applies to goods transported via a waterway, sea, or ocean.

Our policy wordings start with the base of the Institute cargo clauses of which there are three bases of cover starting with the least cover offered whilst the explanation below relate to sea voyages the same clauses apply to Air and Land Travel

We can customise cover to a great extent by using these clauses dependant on your needs usual extensions are:

- Exhibition and exhibition Fees extension

- Temporary Storage

- Installation

Additionally Risks such as War, Strikes, Riot, and Civil Commotion are not covered as standard under the institute cargo clauses. It is possible to provide this cover on payment of an additional insurance premium, but cover is not guaranteed to be supplied and there is a provision that it can be withdrawn upon giving notice to the Insured within a specific period.

Limits Available

Reinsurance capacity has reduced considerably since mid-2019 and this has had an effect on the total amount of cover we can provide for risks so it is important to contact us as soon as possible as it may take time to build limits to that required.

Whilst cover is available there can be restrictions on the availability of War /Terrorism / Strikes coverage due to the ongoing political situation within Iraq.

information required

- As well as the usual company Name and address we will require Directors and shareholders details (required for domestic and international Sanctions and Money Laundering checks)

Where the cover relates to a specific contract or contracts;

A copy of the full contract/work specification wherever possible, if not available at this time then as much detail as can be provided about the contract including:

-

- An overview of the project including timescale and sending’s profile (monthly as and when required etc)

- Insurance coverage requested and limits required

- Details of Principal and any other party who are to be named on the policy as a joint insured if you are not the Principal

- Any claims over the past five year period for the cover that is being requested

We require details of any claims over the past 5 year or where you haven’t had cover any incident over the same period that could have given rise to a claim if cover had been in place

use of captives

Almaseer are used to captives participating in Insurance Programs and will discuss a clients / potential clients captive utilisation in their programme based on the clients own unique needs.